Credit Card Security Tips

Whether shopping online or in-store, there are a few credit card safety tips and good habits to follow to keep your Credit Card information safe and prevent unauthorized transactions. Follow the below guide of credit card security tips to ensure your transactions are secure and protected from potential fraud. Here are some highly recommended and must-know tips:

- Do not give your credit card account information over the phone unless you initiate the call.

- Regularly Monitor Your Credit Accounts. Enrol for and turn on alerts via Online Banking or Mobile Banking App. Keep a close eye on your credit card statements and online accounts to ensure all transactions are authorized. If you notice any suspicious activity, contact your card issuer immediately to dispute the transaction.

- Review Statements Regularly. Regularly check your credit card statements for unauthorized transactions or suspicious activity. At least once per month review your card statements, looking carefully for unexpected purchases or cash advances. If you see any unfamiliar purchases, contact the card issuer immediately to dispute the charges.

- Secure Your Information. Ensure your information is secure when making purchases online or in-store. Avoid unsecured websites by using trusted URLs and retailers. Look for the yellow padlock icon at the bottom of the screen and the ‘s’ in the address bar i.e. ‘https’ indicating that the site is secure and avoiding using public Wi-Fi.

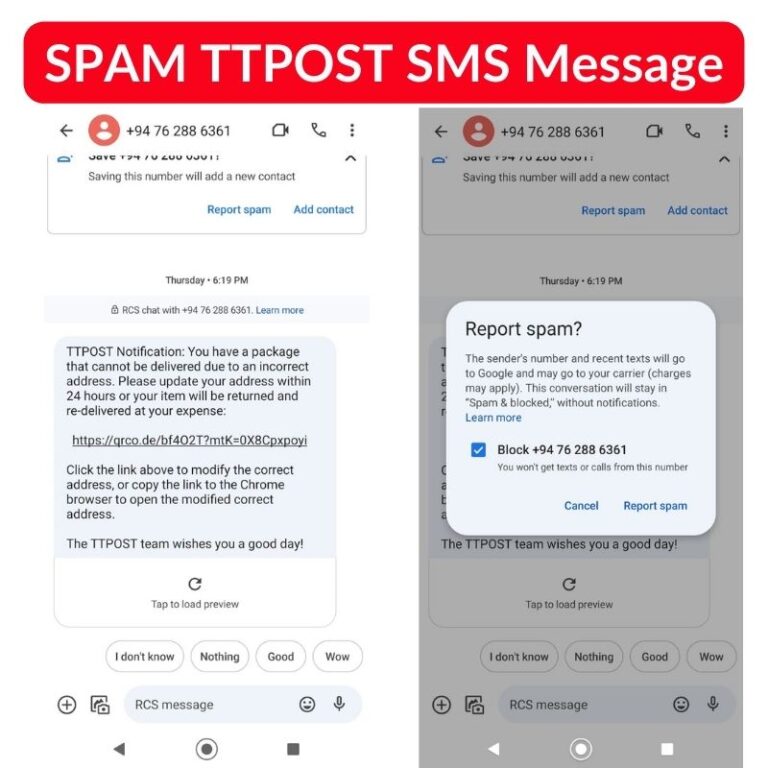

- Do not click on unfamiliar links.

- Cover Your PIN Number: When paying in-store using a chip and PIN machine, make sure nobody is watching as you type in your PIN. Use your hand to hide the keypad as you type to prevent others from seeing your PIN. Keep your card hidden from other consumers.

- Require Card Verification Value (CVV): Require the three-digit or four-digit code called a CVV or Card Security Code (CSC) to add a layer of security, as the person should have their card with them to provide the number.

- Enroll in Credit Monitoring: Enroll in credit monitoring or identity theft protection plans to receive notifications when credit checks are performed on your file, allowing you to spot suspicious activity and act quickly if you suspect fraud.

- Secure Your Physical Cards (VISA or Mastercard): Guard your wallet or purse carefully when you are out, and do not leave credit cards unattended. Keep credit cards you do not use in a safe place at home.

Conclusion

Report any suspicious activity on your card immediately to your bank. By following these highly recommended and must-know credit card security tips, you can significantly reduce the risk of fraud and ensure your transactions are secure and protected.

Click here to learn more about credit card safety best practices.